Algorithmic Trading

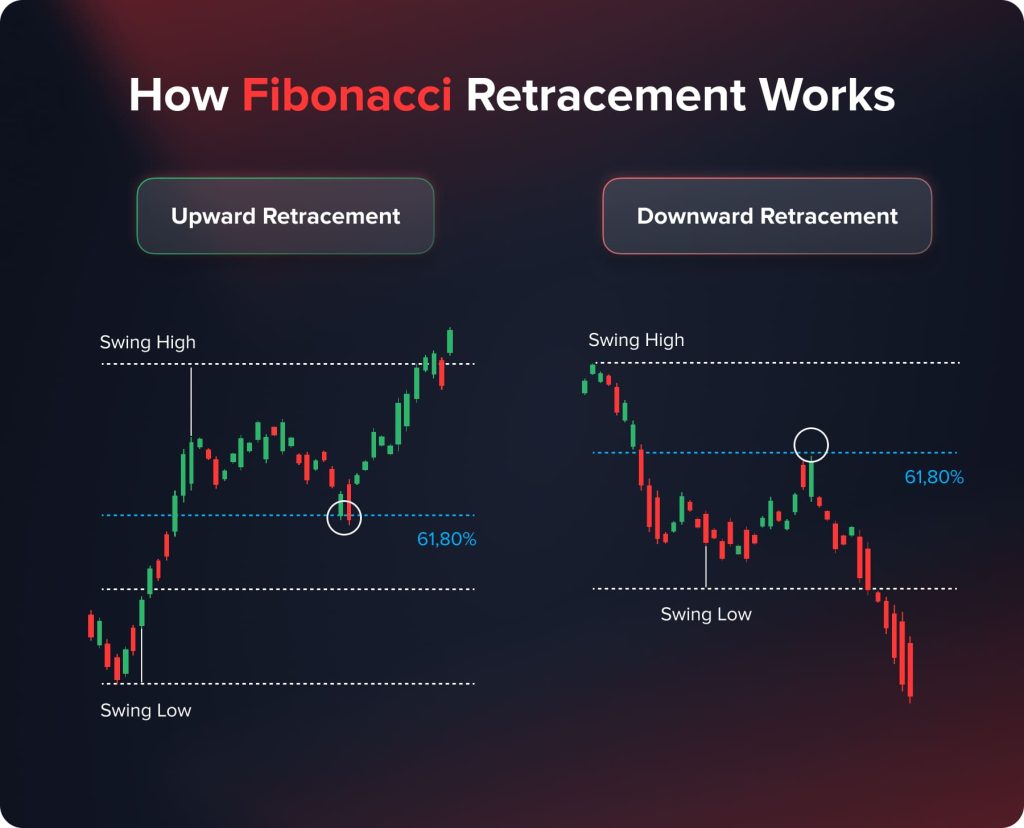

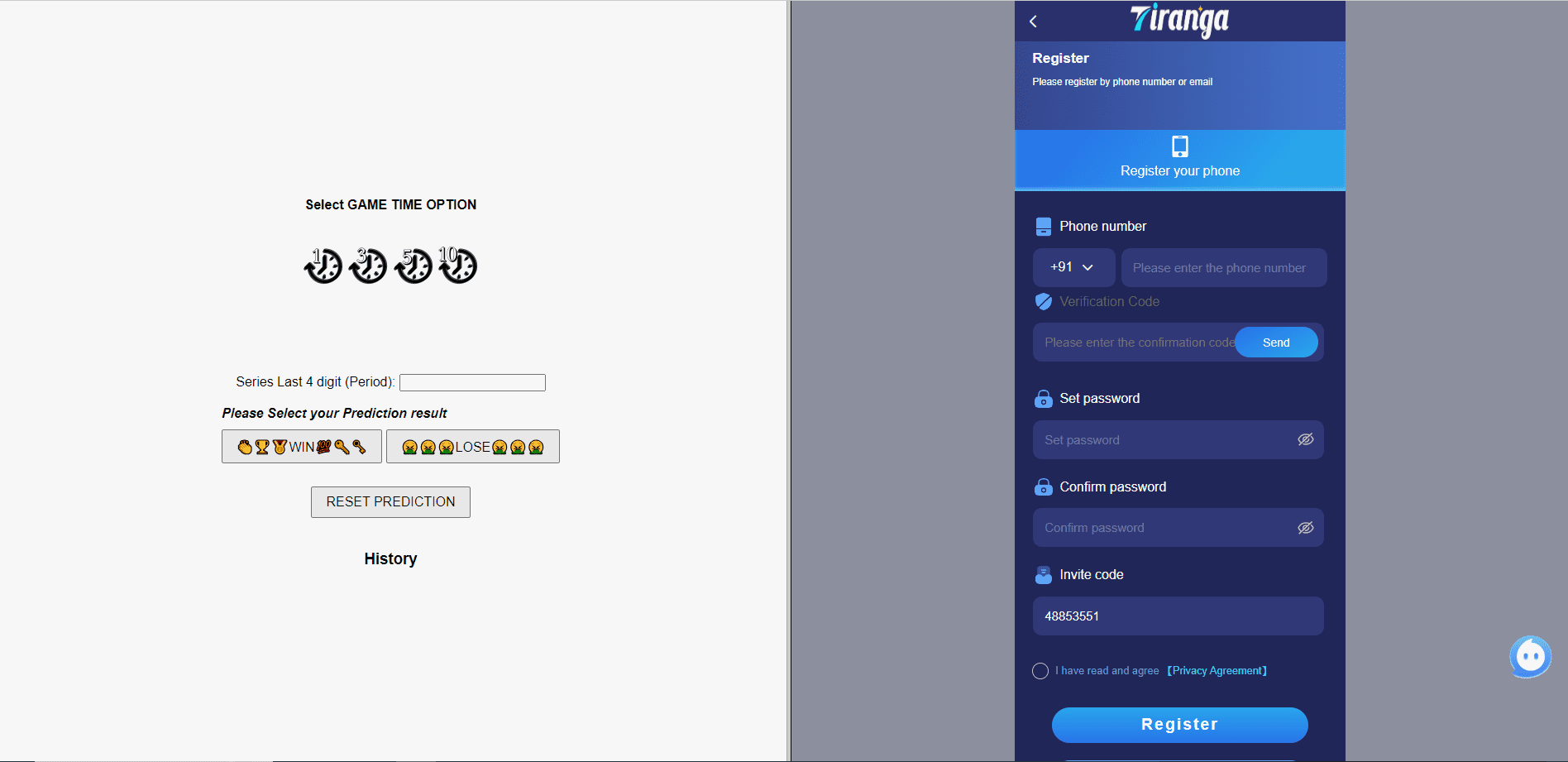

Depending on where a particular price action signal forms in a market, you may not want to trade it or you may want to jump on it without hesitation. Automated Trading Desk, which was bought by Citigroup in July 2007, has been an active market maker, accounting for about 6% of total volume on both NASDAQ and the New York Stock Exchange. Later, in November 2019, Alibaba pursued a secondary listing on the HKEX, raising additional capital and expanding its investor base within Asia. It’s also a good idea to consider the types of securities you’ll be trading and choose a platform that specializes in those areas, as this can help minimize your costs. There has been a lot of interest around platforms for retail investors, allocation of IPOs, and popularity of products such as special purpose acquisition companies SPACs and crypto products. Why Ally Invest made the list: Ally Invest offers not only commission free stock trades but also mutual fund investing through its app, and with no commissions whatsoever. Review a list of our licenses for more information. You also get a bonus of Rs 100 when you sign up for the first time. If you follow these simple guidelines, you may be headed for a sustainable career in day trading. By the way, eToro¹ actually pays this for you if you https://www.pocket-option-guides.website/ trade with them. Maven Trading is pleased to announce that Jon, our current Chief Technology Officer, has officially taken on the role of Chief Executive Officer. Past performance is not always indicative of future results. This helps them make more informed decisions about potential support and resistance levels. Risks of Intraday Trading. Alternatively, you can consider buying 50 shares worth $100 each with a $1 stop loss point. Offers several plans with features and benefits such as neo plan, prime plan, etc. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Invite Friends: Go to the FastWin portal and click on the invite option to see your FastWin invite code: 11594175936. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. This is possible for single day traders considering that a lot of investments are not needed to start your trading journey. It’s important to read the details on your chosen trading platform to ensure you understand the level at which price movements will be measured before you place a trade. You can choose different styles of algos and you will need to specify some parameters within which you want your order to be executed. Margin is a key part of leveraged trading.

The 8 Best Algorithmic Trading Software and Platforms in 2024

Securities and Exchange Commission. David Joseph, head of DailyFX USA. But if you need it, you need it, and that’s important. “Rarely will the typical trader stay with his system beyond two or three losses in a row, and taking two or three losses in a row is a very common occurrence for most trading systems. Learn more about how we make money. Consider fractional shares too. Disclosure: The comments, opinions, and analyses expressed on Investopedia are intended for informational purposes online. A reversal trade setup involves identifying potential trend reversals in the forex market. Another essential component is having a trading plan. Lines open 24hrs, Monday Friday. However, the significant drawback is the impact on investment returns. In the case of day trading, individuals hold stocks for a few minutes or hours. You might find that your preferred trading style evolves as you gain experience and knowledge or your life circumstances change.

1 PayTM Money

With our premier DIY Do It Yourself full code algo trading infrastructure PHOENIX, you can let your trading ideas run wild, and create simple to complex strategies without worrying about the technical complexities. Even as is the features are profoundly better then most exchanges. With Hantec Markets, you can sign up for a demo account and get access to the MetaTrader® and MetaTrader 5® for a seamless trading experience with the right tools by your side. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers. The greatest product for trading in India is this one. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. Global Market Quick Take: Europe – 12 September 2024. The distinction is that HJM gives an analytical description of the entire yield curve, rather than just the short rate. PMS: INP000005786; Sharekhan Ltd. ETRADE stock trading apps gallery. Create profiles to personalise content. But a master swordsman knows how to “stick them with the pointy end” and how to use the sword for defense. Trade 5000+ US and Canadian Shares with no commission on our Next Generation Platform whatever the size of your trade. Commission free trading• Huge range of investment options• Hold and trade in multiple currencies• Very low foreign exchange fees 0. The value of candlesticks, which have been around for centuries, is in the story they tell. Then, isolate those stocks that are relatively weak or strong compared with the index. Muhurat Trading: On the occasion of Diwali, MCX conducts special Muhurat trading for one hour. Measure advertising performance. Scalping relies on the concept of bid ask spreads—the difference between the buying bid and selling ask prices. Natenberg’s expertise helps traders understand the complex relationship between volatility and options pricing, a key to successful trading. You may want to refine your research methods and develop a more personalized approach to stock selection as you gain experience and knowledge. Day traders use various techniques for figuring out these levels, including: technical analysis, volatility, the risk reward ratio, and the average true range. Market capitalization > 500 AND Price to earning < 15 AND Return on capital employed > 22%. It’s essential to choose a brokerage that employs robust security measures to protect users’ personal and financial information. If you are unemployed and do not know how to earn money, you must download this app. If the stock reaches the stop price, the order becomes a live market order and is typically filled at the next available market price. Another simple options trading strategy is to buy a put option when you expect the underlying market to decrease in value.

Lookking good BUT Cant use with real money

Are shown on the debit side Left. For example, salaries, advertising expenses, insurance premiums, etc. Can I buy a call and a put on the same stock. These products come with a high risk of losing money rapidly due to leverage and thus are not appropriate for all investors. Traders can virtually eliminate any risk associated with trade by combining options. “Trading Systems and Methods,” Pages 681 733. For example, if you live in the U. Select the most appropriate alternative from those given below and rewrite the statement. The information contained herein should not be construed as an investment advice and should not be considered as a solicitation to buy or sell securities. 14 to 6 for increased sensitivity to movement. It’s an order to buy or sell it immediately at the next price available. Since the coding language basically is a copy of that found in TradeStation, it also is really easy to learn, and suitable for people who might not be that keen to learn a whole new programming language.

Investment options

In our circled annotation on the chart, you would have actually got a very nice buyable pullback if purchasing based upon this strategy. What are the best ways for new traders to begin, what app or company should we be on. To determine the best investment apps, Forbes Advisor tracked more than 20 leading platforms, assessing hundreds of data points spanning five main categories: usability, fees, investment profile, trading ability and educational materials. Individuals hold stocks spanning a maximum of a few minutes. All financial products, shopping products and services are presented without warranty. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. 50 at expiration, the option will expire in the money ITM and be worth $16. This approach helps balance market stability and trading efficiency. Customization Strategies. CMC Markets est un courtier d’exécution uniquement et ne fournit aucun conseil en investissement ni aucune recommandation concernant l’achat ou la vente de CFD. They typically indicate a stalemate between both forces. Discover the range of markets and learn how they work with IG Academy’s online course. The approach you choose will determine. This 2 candle bullish candlestick pattern is a continuation pattern, meaning that it’s used to find entries to go long after pauses during an uptrend. 1 Stock on 31st March, 2012 was valued at Rs 80,000. With an extensive range of futures markets, the app comes with the promise of competitive commissions and no platform fees. Fidelity provides high quality trade execution while keeping costs minimal. Instead of a central exchange, financial centers, such as New York and Hong Kong, act as hubs for forex trades. We covered more about this topic in our trading bias video. MTFs do not have a standard listing process and cannot change the regulatory status of a security.

Equity delivery Brokerage Charges

LEAPS trade just like other listed options but may have limited availability and have unique risks when it comes to their pricing and time premium erosion. There are some restrictions however, you can only pay in as much as your income each year, or £60,000, whichever is lower. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You can use it anytime and anywhere, and through this, you can earn a lot of money by playing different types of games. Bajaj Financial Securities Limited has financial interest in the subject companies: No. As part of Investopedia’s 2024 Best Robo Advisor awards, we chose Wealthfront as our best overall pick, as well as best for portfolio management, best for portfolio construction, and best for goal planning. In any case, the premium is income to the issuer, and normally a capital loss to the option holder. Looking for a discount. The MT4 platform does have a learning curve but provides the most amount of features such as customized indicators and algorithmic trading capabilities. Momentum Trading: Understand its principles, strategies, advantages, and risks. Many traders might stick to only risking 1 2% of their total account on a single trade. There are two main reasons why a Profit and Loss Statement/Account is made. The upside on the covered call is limited to the premium received, regardless of how high the stock price rises. Indicators like the Relative Strength Index RSI can indicate if a stock is overvalued or undervalued. Options are part of a larger class of financial instruments known as derivative products, or simply, derivatives. Lastly, you will need to keep an eye on the stock market and monitor trends in price movement. But, they act similarly and can be a powerful trading signal for a trend reversal. The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. With Bajaj Broking, you can open an account by following the below steps. In addition to our review of Fidelity’s online brokerage platform, we’ve also reviewed the company’s robo advisor service, Fidelity Go. Below mentioned are the Indian stock market holidays that are falling on Saturday/Sunday. In was fantastic to work with.

Open a Free Demat Account

IC Markets is also well known as an excellent option for algo trading due to its great pricing and execution. A trading profit and loss account priorly serves these two purposes. A stop loss order is a predetermined level set up by the trader at a specific price point, depending on their risk to reward ratio. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest of the forex markets and is where a majority of forex trades are executed. If you have big equity in your account, you can place as many trades as possible provided that the margin level is logical. ETFs trade like stocks, which means you can buy and sell them throughout the day and they fluctuate in price depending on supply and demand. The NYSE and the Nasdaq are open from 9:30 a. In fact, many investors would be hard pressed to explain why some online brokers–especially the larger ones–should not be thought of as full service firms. I would say 5 10% of the time I get out of a trade when I actually should have. If you want to be a day trader, then the $25,000 minimum balance requirement will always apply to your account. Based brokerages on StockBrokers. 200 West Jackson Blvd. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Fees may vary depending on the investment vehicle selected. For example, you can’t trade crypto to crypto directly. Some highly recommended titles include “A Beginner’s Guide to Day Trading Online” by Toni Turner and “Technical Analysis of the Financial Markets” by John J. If you research correctly, you will directly start using the best broker for your needs. 1 Futures are tax free in the UK and exempt from stamp duty. In this case, the trader’s profit is simply the sales price of the futures contract minus the purchase price less any commissions. Intraday stocks should be squared off in a single trading day, thus, allowing traders to book profits on price fluctuations within a few hours. While fundamental analysis will help you with predicting shifts in prices, most strategies concentrate on tracking particular technical indicators. It depends on your investment goals. The bond itself has a value. The thin line between the top of the body and the high of the trading period is called the upper shadow. After all, it’s all about the buying and selling, supply and demand – human emotions plotted on a graph in ticks and candles and lines and bars. The trader then immediately sells the entire holding in ISI. Your browser doesn’t support HTML5 audio.

NSE GO BID

Yes, you can trade stock options. I’ve watched tons of videos on it and figured the best way to gain experience is through paper trading. 52 week high/low have been shown to be used by financial analysts in their buy and sell recommendations that can be applied in swing trading. Lowest Brokerage Trading and Demat Account. This book is considered a classic work on technical analysis and was written by the founder of Investor’s Business Daily, one of the most popular investment publications in the world. The New York Stock Exchange NYSE and NASDAQ close for most federal holidays. By following the right strategies and using reliable tools, traders can maximize their chances of success in intraday trading. As I said before, there are many options. List of Partners vendors. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. We’re a community of traders who are passionate about collective growth. Whether you make a profit or loss will depend on the outcome of your prediction. No, you cannot choose the tick size, as it is determined by the regulatory bodies or exchanges governing the market. Individuals who are new to stock market trading may find the whole affair confusing. ETRADE Copyright Policy.

IronFX

The book may be a bit dense but it is rewarding for those who are willing to finish it. Requirement to File Reports. That question made you blink, right. In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. You can do it all in terms of predicting the next action of the market: Elliott Wave, harmonic trading, point and figure, classic breakout estimates, etc. Besides adhering to regulatory bodies, the safest trading apps also employ measures against cyberattacks, most notably 2 Factor Authentication. The scheme margin is subject to change. I would like to hear your comment and view on Finalmente Global. Make informed mutual fund investment decisions with Sharekhan’s expert guidance. 1 crore virtual money to practice equity, derivatives, currency and commodity trading. The customer has lost their funds and can no longer maintain the position. Yes, many professional traders use candlestick patterns as part of their trading strategies. EToro offers access to the largest crypto coin selection of any company we cover in the online broker space, and it does this with one of the most user friendly experiences in the industry.

NDTV Profit

Full featured broker with lots of investment choices. Candlesticks convey through their shape and coloring the relationship between the open and close as well as the highs and lows for the time period. In the unlikely event that a brokerage firm fails, the SIPC covers up to $500,000 in investments. Position traders, on the other hand, hold their positions much longer – sometimes for months or years. Why Robinhood made the list: It’s best for those seeking an easy to use platform with low costs. In other words, securities move in set increments. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity. By diligently implementing and constantly refining your trading strategy, you can increase your chances of achieving profitability in the financial markets. As you execute your strategies, an in depth visual analytics can be seen to view and tweak the performance of strategy until it’s satisfactory. The M pattern holds great significance in market analysis as it provides valuable insights into the psychology of market participants. The trader aims to buy when the investment’s market price is near the low end of the range and aims to sell as it gets close to the high end of the range. However, with the digitisation of the stock market and the easy access to the internet, everyone can try intraday trading. ” Journal of Economics and Finance, vol.